Financial Literacy

Many people lack a basic understanding of their own finances, and as the years go by there are crucial opportunities being missed and potentially devastating mistakes being made. Learning how to plan for short and long-term goals, how to prepare for a financial-related emergency, and understanding other important topics can benefit you greatly.

I would encourage each viewer to utilize the information on this site and start planning for their financial future today!

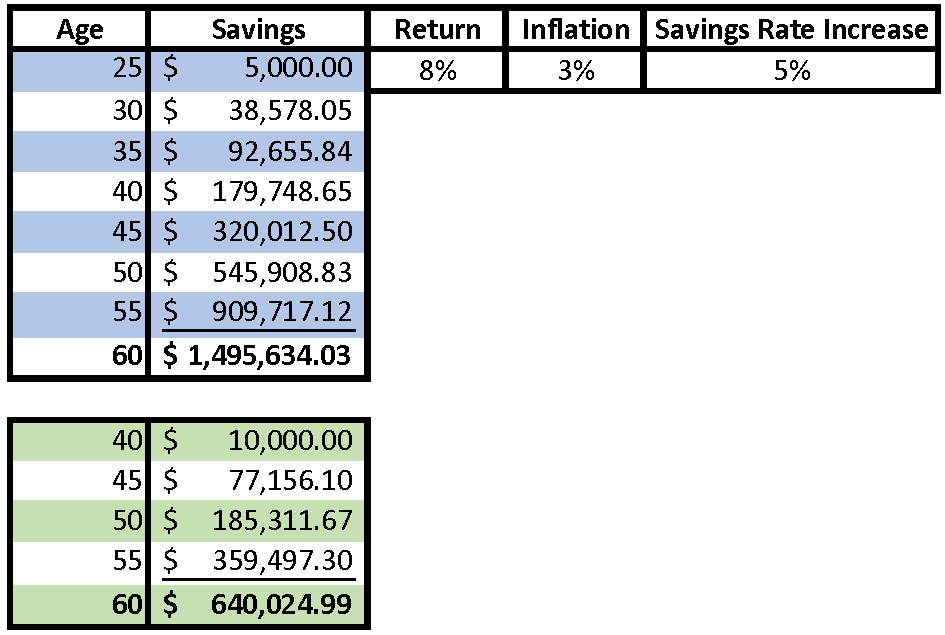

Saving for retirement: The cost of waiting

The first scenario below shows what a 25-year-old will have saved if they start saving $5,000 annually and increase that amount by 5% each year until they are 60 years old. We will also assume an investment return of 8%, and inflation of 3% (this results in a "real return" of 5%). The ages are shown in increments of 5 years to show the growth of savings over time until the final inflation-adjusted amount of $1,495,634 is achieved by age 60.

The second scenario (in green) depicts a 40-year-old who begins saving $10,000 each year and is only able to save roughly 43% of what the 25-year-old was able to stash away, despite saving double the amount yearly. The 40-year-old likely earns a higher income than their younger counterpart, but they will never make up for the years of compounded investment earnings they have missed out on.

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes.