Plan For Your Retirement

Many young persons may view planning for retirement as something to consider when they're closer to their middle ages, or when they have the "dream job" or have "settled down." This is a common mistake that will cost the youthful crowds years of potential investment returns that they will NEVER get back.

When planning for the future, time is by and large the most valuable asset at one's disposal. Organizing your finances as a youthful individual is also incredibly simple, and can be done yourself without the need for hiring a financial advisor.

Before jumping head-first into planning your financial future, think about the goals you want to achieve. A basic outline of a few common goals to strive for as a young person is described below, compare and contrast these examples to develop your set of goals and how you plan to achieve them.

Goals-Based Planning:

While it is premature to attempt to develop an accurate retirement plan in your 20s and 30s that will still be relevant years later, positioning your capital in such a way to optimize growth potential is imperative in achieving financial independence.

Below are a few ideas of some fairly common goals that many young persons may or should have, the timelines will of course vary for each individual and their unique situation:

Start with developing a realistic set of goals you would like to achieve, with short, medium, and long-term timelines. For example:

- Build up a solid credit score within 1 year

- $35,000 in investable assets in 2 years

- House purchase in 3 years

- Be able to semi-retire in 25 years

Next, assess how to achieve your goals:

- Pay off credit card balances monthly, avoid using more than 30% of available credit, consistent and timely payments

- Open & contribute to an Employer-sponsored plan (401k, etc.), Roth IRA, Taxable accounts

- Save for an optimal down payment amount in a Taxable account and or Bank account

- Invest in a simple and consistent manner, spend less than you earn, set-up automatic contributions to retirement accounts, avoid depreciating assets *article on appreciating/dep. assets*

Finally, execute your plan:

- Open a credit card with automatic payments set to pay off the balance in full each month. Choose a credit card that offers benefits most attractive to you, such as acquiring air miles, cash back benefits, etc. Research the card you will be choosing before submitting an application because this card will ideally be a part of your life for years to come. Closing out a credit card can severely impact your credit score. **If you have a tendency to over-spend with access to a credit card, consider only using one for certain expenditures until you can build up reliable enough behavior to spend responsibly. For example, using credit for gas, groceries, etc.

- There are many types of investment accounts available to the average investor, with each account possessing its respective strengths and weaknesses. Utilizing the strong points of each in conjunction with one another is typically the most effective approach. Read more to learn where to invest.

- Determining an optimal amount for a down payment on a home is obviously highly dependent on the value of the home itself. What is the typical market value of homes that you're interested in? In order to encounter lower interest rates on a mortgage, a safe bet is to put down 20% of the value of the home as a down payment and to have a few extra thousand in savings for closing costs.

- Committing to investing your income in a consistent manner is the first part of the equation, determining how to invest your capital is the final part.

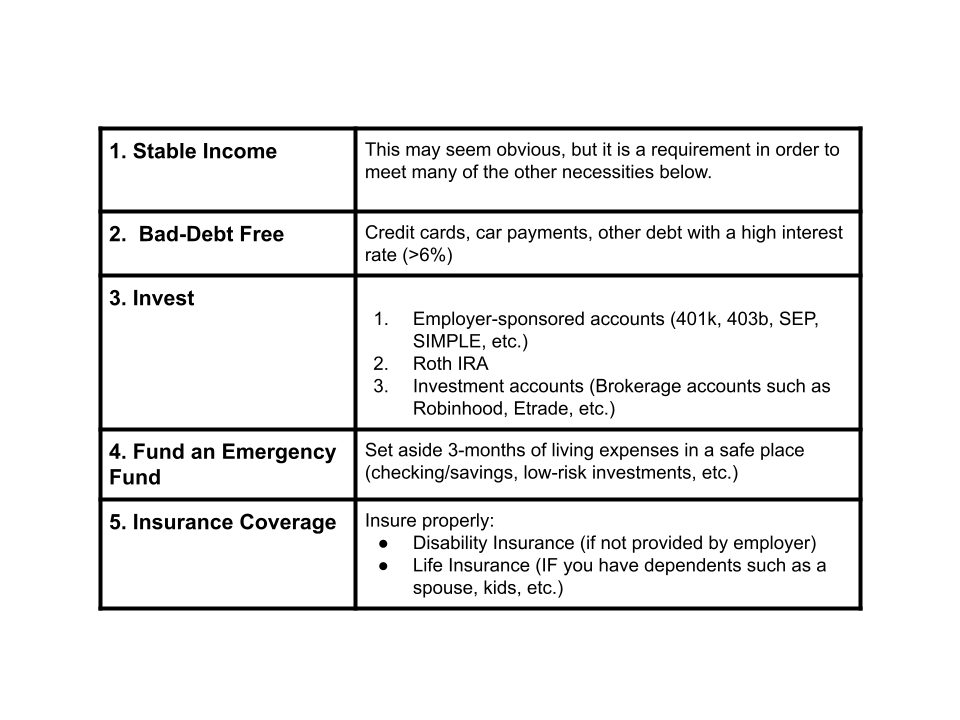

Make sure that your financial “house” is in order before devising a plan to save and invest your cash to fund your future goals. As a young person, there are not many hoops to jump through, but there are certain items to address in order to prevent a financial catastrophe and to ensure you maximize your money's potential.

Investment Accounts:

The most common type of investment accounts available to the average investor includes Employer-sponsored plans (401k, 403b, SEP, SIMPLE, etc.), Individual Retirement Accounts (Roth IRA, Traditional IRA, etc.), and general investment accounts (Brokerage accounts such as RobinHood, E*Trade, Vanguard, etc.).

For the purpose of educating young people on investing in accounts that are most beneficial to them, I will focus on Employer-sponsored plans, Roth IRAs, and investment accounts.

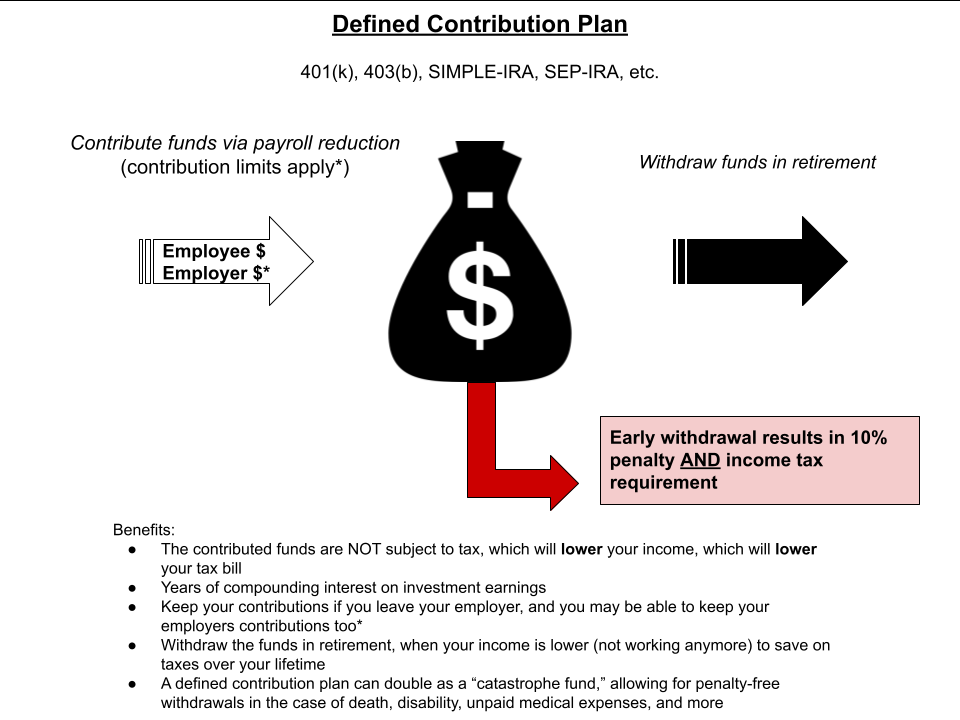

Employer-sponsored Retirement plans (401k, 403b, SEP-IRA, etc): These plans are the most commonly available to US employees by and large. Defined contribution plans are predominantly pre-tax (monies taxed when withdrawn, ideally in retirement) and allow for employees to contribute a maximum of $23,000 (2024) each year, along with the employer being able (though may not be required) to contribute a percentage of an employee's salary into the account.

There are several types of employer-sponsored plans, with the most common being the 401(k), but there are many others such as 403(b) plans which are available to employees of public schools and other tax-exempt organizations. Though most of these pre-tax plans operate in a very similar fashion, each has its own characteristics and specifications that apply only to them.

How does one "invest" in their employer-sponsored plan? This depends on the custodian your employer has elected to oversee employee accounts. I stress the word "oversee" as it is purely the responsibility of the employee to manage their own investments in the account, the plan provider is simply the custodian of employee accounts.

Many employers will use Vanguard, Fidelity, Charles Schwab, and others to custody their company's plan. Depending on how much your employer is willing to spend, a predetermined list of investments will be available to choose from ("investment options").

The information discussed above is more than enough for most people to be aware of, but the details can be viewed in greater depth here.

Individual Retirement Accounts (IRAs):

IRAs (Traditional or Roth): Individual Retirement Accounts are self-funded retirement accounts, with no affiliation to an employer-sponsored account. IRAs are individual, meaning they are not "joint" accounts owned by two or more persons. All that is required in order to contribute funds to an IRA is to have "earned income." If single, you must earn an equal amount of taxable income that is contributed, spouses may contribute for each other if one is not working. Certain income amounts will phase out an individual or couple from contributing to an IRA, view the details here.

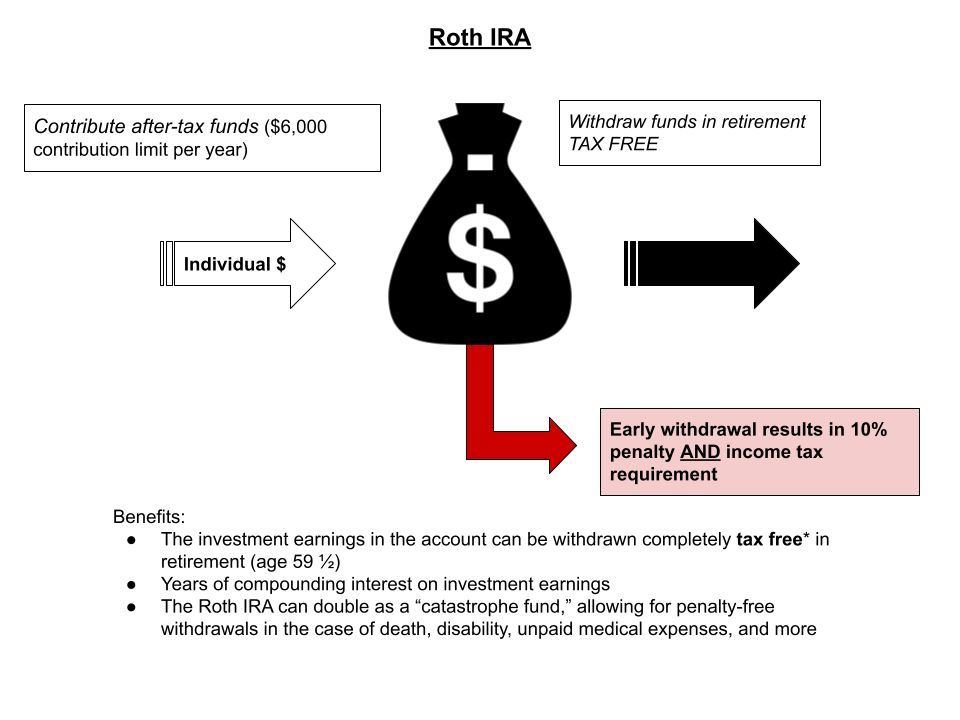

Roth IRA (The tax-free individual retirement account): Roths are arguably the most efficient retirement account that an individual can contribute to, especially a young person. This is due to the fact that most young people are still in the early stages of their careers and their annual income still has years of potential growth before reaching its peak. Having a lower income is a critical part that amplifies the effect of investing in a Roth IRA. So, why is having a lower income so important? It's simple, really. Contributions deposited into a Roth are made with after-tax dollars, meaning that the funds being contributed have already been taxed, and are included in your taxable income for the year.

As an individual naturally progresses in their career, so will their income and as a result, the rate at which they will be expected to pay taxes. The key to a Roth is to invest as much as possible into the account until the IRS no longer allows contributions, which is when a single person's income crosses over $153,000 or a married couple surpasses $228,000 of income. It should be obvious how important contributing to a Roth IRA is when the IRS eventually cuts taxpayers off from contributing due to missing out on too many tax dollars. Start now, before it's too late!

Traditional IRA (The pre-tax individual retirement account): Traditional IRAs follow many of the rules that apply to Roth IRAs:

- $7,000 per year max contribution (assuming under age 50)

- Withdrawals are penalty-free in the case of retirement (age 59 1/2), emergency withdrawals (death, disability, etc.)

- Earned income requirement in order to contribute

The biggest difference between Traditional IRAs and Roth IRAs is, of course, the taxation of each respective account. Traditional IRAs are taxed when withdrawn, not when contributed as is the case with Roths. Essentially, Traditional IRAs incur the same tax treatment as most pre-tax employer-sponsored retirement accounts (401ks, etc.), meaning this individual retirement account will lower an individual's tax bill when amounts are contributed.

Funds contributed into a Traditional are deducted from the owner's income, with phase-out rules based on income. For those employees who have an employer-sponsored retirement account (401k, etc.) offered at their place of work, there are lower phase-out limits. On the contrary, those who do not have a retirement plan available through their employer have no income limits when determining the amount that can be deducted from their income. Separate rules apply for married couples, based on if only one spouse has an employer-sponsored plan, if both have a plan or if neither has a plan.

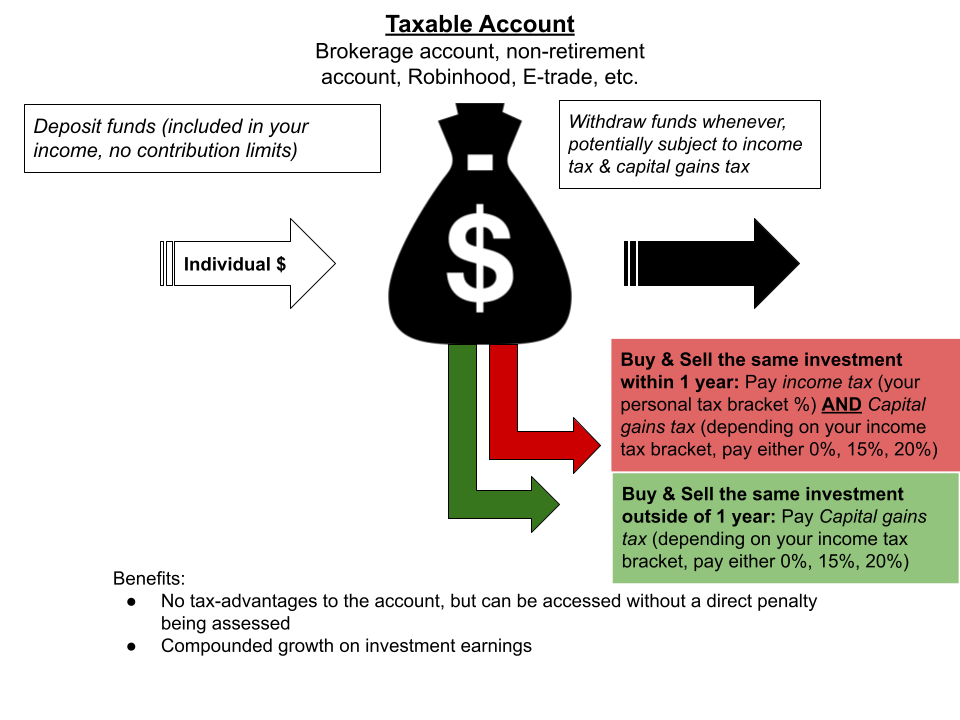

Taxable Investment Accounts: Some of the most notable benefits associated with these accounts are that no maximum annual contribution applies, no withdrawal penalties do either, and they can be jointly owned by 2 or more persons. The IRS allows this to take place as they will be able to collect taxes on profits gained in the account.

There are limited tax-shelter benefits offered as opposed to those available with retirement accounts. The taxation of an investment account is slightly more complicated than is the case with retirement accounts, but it is still relatively straightforward. No tax is owed from the account until a "gain" occurs (or is realized) in excess of the amount originally invested. This "gain" can take on a few different forms, such as a capital gain, dividend, or distribution.

Capital Gains: Not all gains are created equal

- Short-term Capital Gains: An investment is bought and sold (realized) within 1-year (<365 days). The gain on the investment will be taxed at the income tax rate the individual is subject to.

For example, if a single share of Microsoft (MSFT) is purchased at $220 and sold within 1-year for $300, taxes owed on that share of stock amount to the $80 gain multiplied by the owner’s corresponding ordinary income tax rate.

- Long-term Capital Gains: An investment is bought and sold (realized) outside of 1-year (>365 days). The gain on the investment will be taxed at the capital gains tax rate the individual is subject to. This is a separate bracket altogether from income tax rates, and the rates are much more favorable. This is the government's way of encouraging longer-term stock ownership, rather than gambling with the stock market (day trading).

https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

For example, if a single share of Microsoft (MSFT) is purchased at $220 and sold outside of 1-year for $300, taxes owed on that share of stock amount to the $80 gain multiplied by the owner’s corresponding capital gains tax rate.

Income: Income generated within a taxable account is also subject to tax, this may be in the form of a dividend, distribution, or interest.

- Dividends: Dividends are paid to shareholders as determined by a company’s board of directors. Dividends received from a US-based company are deemed “Qualified” and are subject to capital gains rates for taxation reasons, while foreign companies pay out “Non-Qualified” dividends and are subject to ordinary income tax rates.

- Distributions: These are cash payments received from an investment, typically paid out by a Mutual fund as a result of a sale taking place within the fund. The distribution will be characterized as a short-term (ordinary income) or a long-term (capital gains) distribution, depending on how long the securities were held.

- Interest: Income received from a checking/savings account, CD, or bond, is subject to ordinary income tax rates.

So which accounts should you utilize to fund your goals?

Short-term goals (house purchase, emergency fund, additional savings, etc.):

- Utilizing a taxable investment account may be your best bet. Withdrawing funds from a retirement account is not preferable as these funds are best used to capitalize on long-term growth for retirement, premature withdrawals will stunt their growth

- In certain situations, a loan from your 401(k) may be an option to consider. Each plan will vary in its rules and regulations in allowing withdrawals, and should only be considered for smart purchases that will help grow your net worth (buying a house may be a good idea, but buying a car is likely NOT). Keep in mind a loan from your 401(k) is required to be paid with interest to avoid penalties, but the interest will essentially be used to pay yourself back. Ideally, loans from a retirement plan should probably be avoided.

Long-term goals:

- You've probably already guessed the answer, retirement accounts! Tax-advantaged accounts are the best option to consider when planning for your long-term goals, which should include retiring. The more you save, the more likely you are to have a large sum set aside and fund your financial independence.

You've been given a basic overview of the various investment accounts, now head over to Investment Management to learn the basics of investing.

This website is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes.