Basic Investment Considerations

Determining an appropriate investment allocation or "mix" is incredibly important for setting up an investor for success in achieving their various financial goals. Simply investing your hard-earned capital in a similar manner for every goal in which you hope to achieve is NOT an optimal choice. Short-term goals, such as a house purchase in 3 years, warrant a different investment allocation than longer-term goals such as retirement planning. Other key factors to consider include risk tolerance and risk capacity.

- Risk Capacity: This is dependent upon how much potential for loss an investor can realistically afford without suffering devastation. For example, if an investor hopes to retire in 1-year from now before they begin drawing from their 401(k), investing 100% of their savings in stocks may not be in their best interest. Another notable consideration is time, the longer an investor has before they wish to accomplish a goal equates to an increased capacity to take on risk.

- Risk Tolerance: How much risk can you take on before your well-being is affected? Sleepless nights and nervously checking your investment account multiple times a day may be a sign that you have crossed that threshold. That being said, don't let your tolerance for risk dominate how you invest your money to the point that potential growth is being hindered. Be mindful of your preference for risk, but be a good steward of your capital at the same time.

How to determine your tolerance for risk:

There are many resources that can help point you in the right direction in terms of measuring your tolerance for risk, I suggest using Vanguard's free Investor Questionnaire. Filling out a questionnaire is by no means definitive, but it can aid in providing a general idea of how you feel about exposing your cash to the potential risks and rewards of the market.

Specific Allocations:

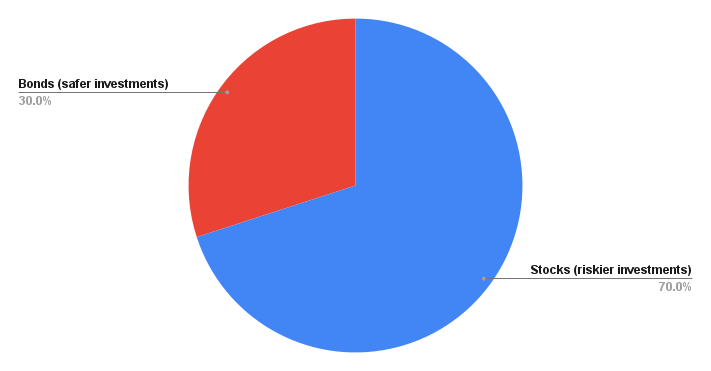

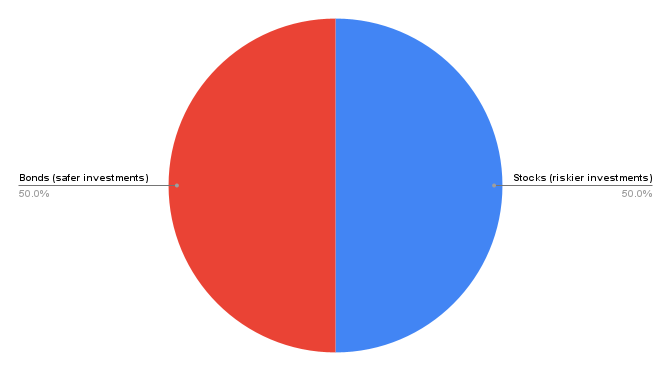

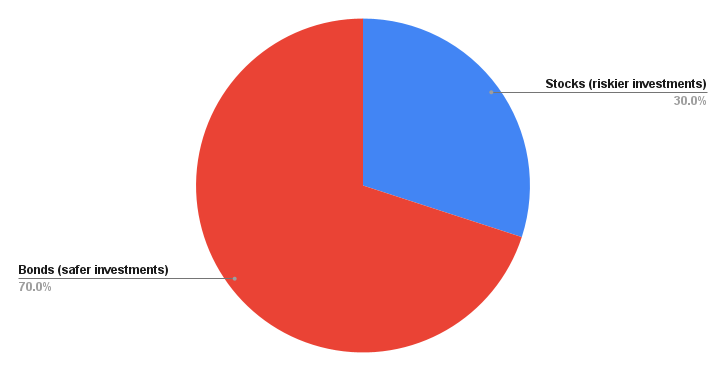

Risk-assessment tools will often quantify investors into a few main categories of risk tolerance, there are many other allocations that provide further details into the type of assets that make up a given portfolio, but for simplicity, we will focus on a few common examples below:

- Aggressive: 70-100% of total allocation in stocks (riskier investments), with the intention of gaining long-term growth. May be suitable for goals that are 6+ years away.

- Balanced: 40-55% of total allocation in stocks (riskier investments), with the intention of stability and more predictable investment returns. May be suitable for goals 3-5 years away.

- Conservative: 25-35% of total allocation in stocks (riskier investments), with the intention of limiting potential losses while keeping pace with inflation. May be suitable for goals 1-3 years away.

Goal funding:

Before deciding how to invest for a particular goal, you should determine where you should be investing. This is in reference to the type of account you will be directing your cash to, such as a retirement account, bank account, retail investment account, etc.

- Short-term (1-3 years) & Mid-term (3-5 years)

Common goals that would fit into this category might include savings for a house down payment, home renovation, necessary car purchases, etc. The funds should be invested in an account that is relatively accessible, such as a retail investment account or a checking/savings account. If the goal involves the purchase of an appreciating asset, taking a loan from your 401(k) or similar retirement account may be worth consideration. Using retirement accounts to fund depreciating asset purchases should be avoided at all costs unless an emergency situation demands it. Simply leaving the funds in cash is not ideal (unless they will be needed particularly soon) because although their monetary value may appear to be stagnant, inflation will slowly eat away at any cash assets year after year and actually decrease the value of your capital. Consider a diversified, low-fee investment fund or a Certificate of Deposit with a competitive rate. Investment funds such as the one below provide adequate diversification inside of a single fund, which may be advantageous for investors who are easily overwhelmed by investing across an array of investments. Since AOM is a passively managed Exchange-Traded Fund, tax efficiency is also an added benefit as capital gains distributions are less common compared to an actively managed fund.

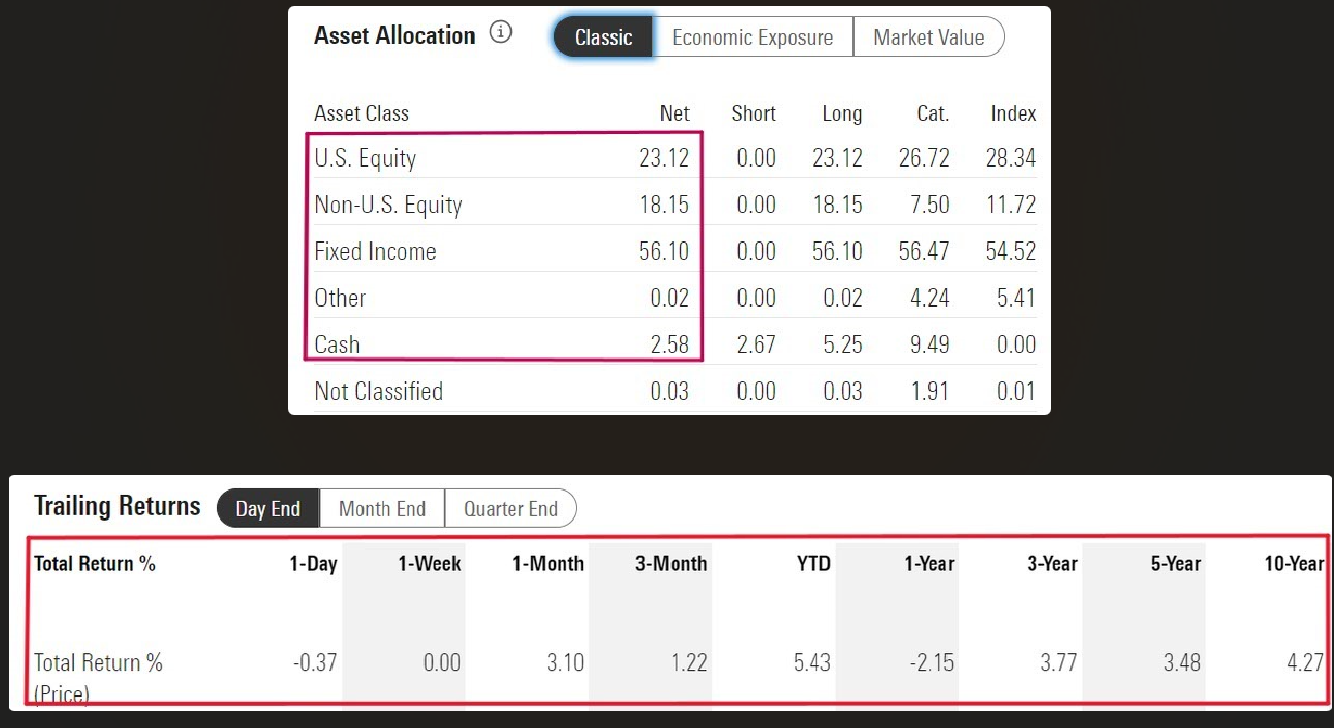

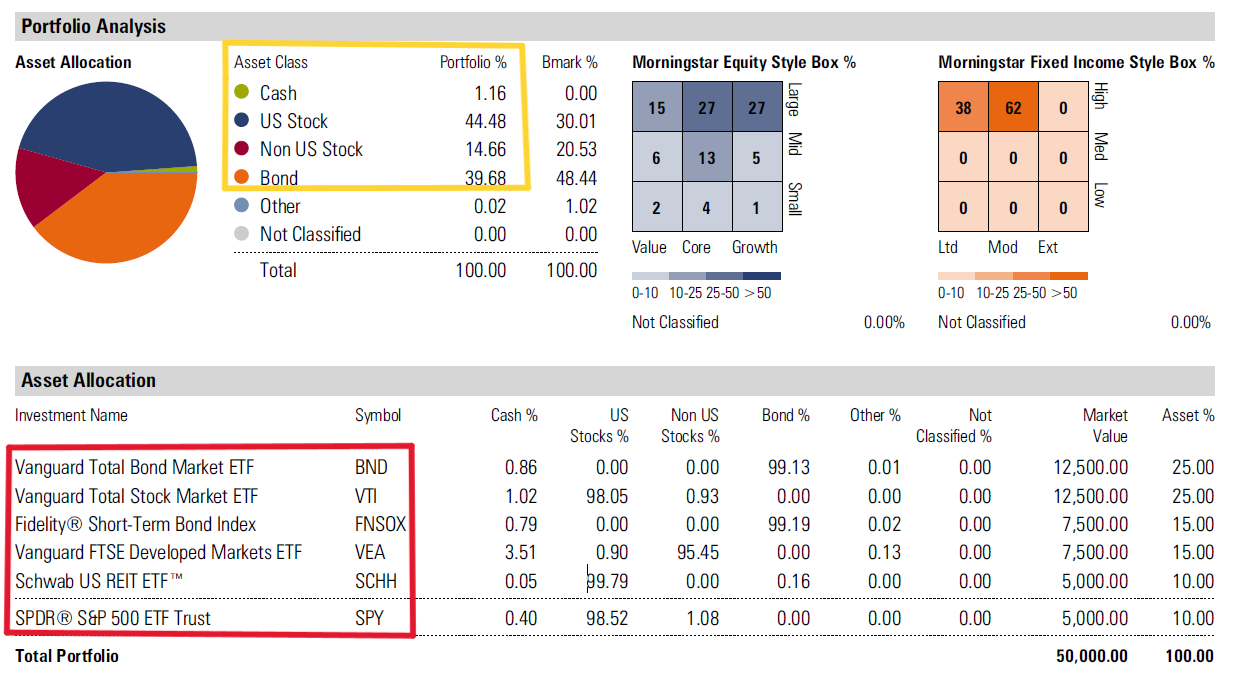

iShares Core Moderate Allocation ETF - AOM

Instead of investing in a single fund, some investors may prefer to have more control over their investments. Constructing a portfolio with index funds provides adequate diversification, and can easily be accomplished using cost-effective investments. Below is an example of a Balanced portfolio, comprised of 50% equity assets (US large, medium, small, and International stocks), and 50% fixed-income assets (US bonds, Real Estate Investments). Despite investing in only two bond funds, there are almost 19,000 different bonds owned between these two funds. Likewise, almost 9,000 individual companies are owned between the stock funds. With such a wide selection of securities present in this example portfolio, investors can capture the performance of both US and international stocks, as well as bond and real estate markets.

- Long-term (6+ years):

Depending on the investor, long-term goals (most commonly retirement savings) should be accompanied by a portfolio that is positioned for growth. Relative to the Balanced portfolio above, simply swapping out or significantly lowering the allocation to the bond funds and instead adding a few more equity positions could be considered for an investor seeking growth.

Adding to these positions consistently over time will very likely yield impressive results, assuming the investor embraces a passive investment style, and allows the account(s) to compound for years to come.

Invest well and invest often!

Disclosure: There is no guarantee investment strategies will be successful. Investing involves risks including possible loss of principal. Diversification does not eliminate the risk of market loss.

All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.