Are Pensions Actually Better Than 401(k)s?

Many people today are under the impression that pensions are outright superior when compared to 401ks or other defined compensation (DC) retirement plans.

The falsehood that greedy corporations chose to provide lower retirement benefits to their employees throughout the years tends to add fuel to this belief. The real reason pensions started to become phased out for DC plans was due to increased government regulation in the 1980s, which gave employers more of an incentive to cut costs on sponsoring employees with a pension plan and instead to shift savings and investment responsibilities on the employees themselves. Regardless of how DC plans rose to prominence, are pension plans (defined benefit plans) necessarily better in all circumstances? The answer may surprise you.

It depends (surprise surprise). A significant consideration needs to be taken into account when delineating DB pension plans, which are those that offer Cost Of Living Adjustments (COLAs) and those that do not. COLAs essentially provide annual increases to a retiree's pension benefit amount to account for inflation, a common percent increase is 3%. This percentage may seem insignificant, but compounded over time, this amounts to exponential increases in total benefits received. It's not difficult to imagine how expensive it would be for an employer to provide its employees with a DB pension plan, especially with Cost Of Living Adjustments. For a company to provide such benefits, they would need to have extremely consistent cash flows and would need a certain level of confidence that their business will continue to generate strong earnings 20-30+ years into the future. Few businesses today would feel comfortable making such claims, which is why the only entities that can offer such generous benefits are governmental agencies, because, after all, nothing in life is certain besides death and taxes (try to think of a more consistent cash flow than tax revenues..). This leaves the remaining DB plan sponsors in the private sector to offer pensions that do not provide retirement benefits adjusted for inflation.

Starting Young

If you've read just about anything on this website previously, you hopefully understand the importance of investing ASAP. Investing early and often allows for your savings to compound and grow throughout your lifetime. With this in mind, 401(k)s can provide substantial benefits when they are utilized early on in an investor's lifetime and are almost always comparable to DB pension plans in addition to DB pension plans with COLAs.

Hypothetical

Creating hypothetical scenarios based on historical data is NOT a 100% proven tool, but like a Capitalist Economy, it is the best option currently available to society and can provide helpful insights.

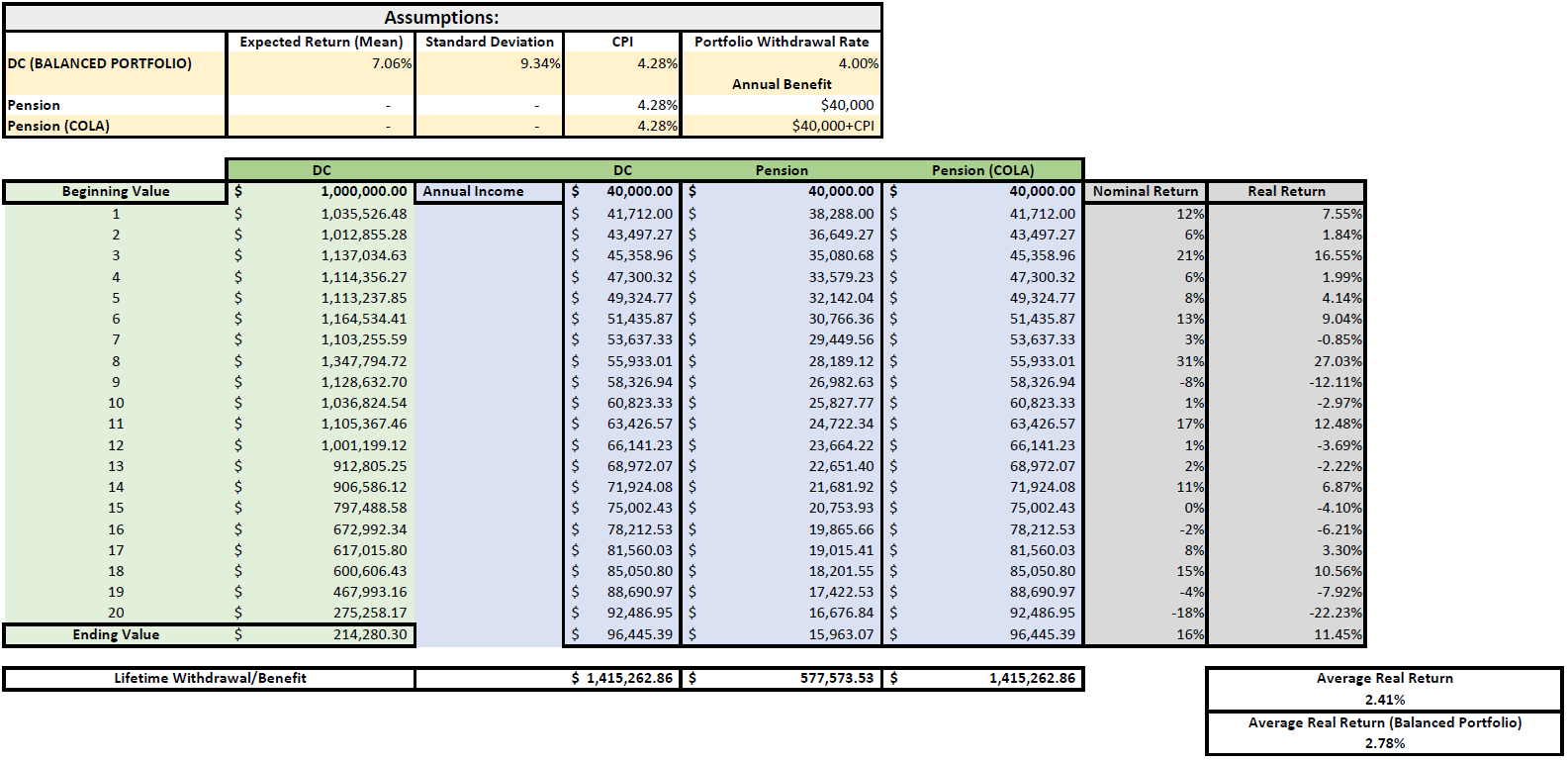

Don't get overwhelmed by the spreadsheet below, it is simple in nature. The basic assumptions in this scenario are that inflation ("CPI") remains at the 40-year average of 4.28% and that an investor earns average historical real returns (Real=inflation adjusted, Nominal=non-inflation-adjusted) of 2.41% (with a single standard deviation of 9.34%) for a Balanced Investment Portfolio. Within these parameters, a randomized set of returns is produced (gray boxes in the lower right).

We also assume an investor has 20 years in retirement and wants to live on $40,000 every year. The three scenarios below (DC, Pension, Pension (COLA)) show the discounted future values of $40,000 throughout the 20 years of retirement.

- Pension: The $40,000 future withdrawals are discounted back to show its present value in today's dollars. This retirement benefit provides the lowest total lifetime withdrawals when compared to the other options.

- Pension (COLA): The withdrawals adjust each year for annual inflation (4.28%).

- DC: This scenario assumes a retiree has $1mm in a tax-deferred retirement account. This is shown in the account value decreasing most years, before finishing with an ending account balance of ~$215,000 by year 20, while providing the same inflation-adjusted withdrawals that the Pension (COLA) provided.

At the end of the 20 years, the DC and Pension (COLA) have provided an equal amount of total lifetime withdrawals, though the DC is left with an additional ~$215,000 account balance.

This is not to say that the DC plan is flat-out better, though it certainly has its advantages, such as the potential for superior investment returns, the ability to utilize Roth Conversions (tax & succession planning benefits), and generally more control when compared to a pension. Pensions are commonly sought after for their guaranteed lifetime benefit, which is appealing to many retirees who are worried about losing sleep at night in retirement.

The reality is that while each retirement savings vehicle may have its inherent advantages and disadvantages, DC plans are going to continue to become more prominent throughout the years. Those that neglect to save into these accounts may foster strong feelings of regret when they'd like to hang up their boots one day and find out they can't afford to.